For Insurers

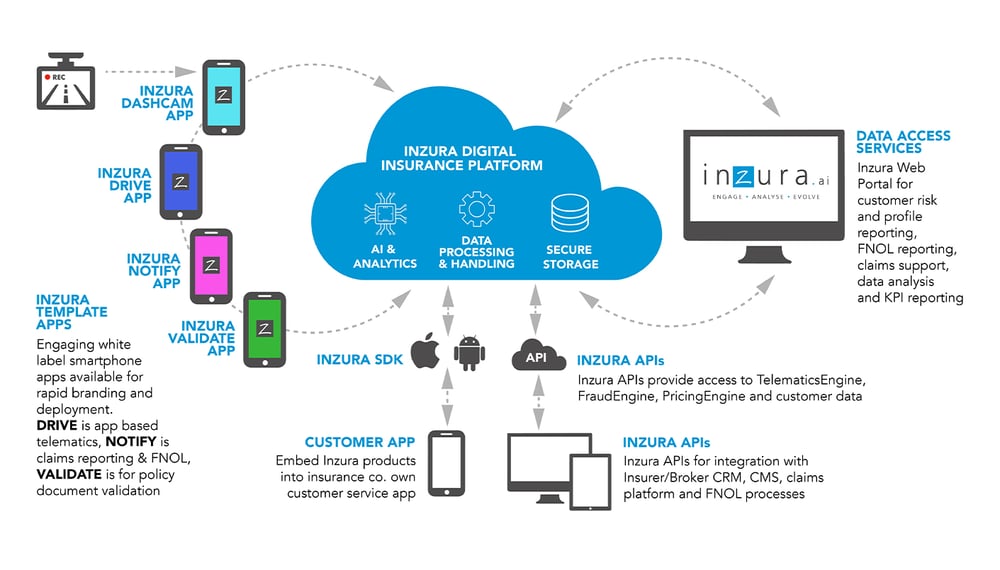

The Inzura platform supports rapid deployment of advanced digital products including our white label smartphone apps. Our platform has been built to manage real-time customer interactions and complex data processing allowing our insurer customers to deploy digital products whilst still using their legacy core systems.

Hosted in the AWS cloud, we are able to provide secure high availability and highly scalable services. We host, process and analyse all of your rich customer data minimising the impact on your current IT team and infrastructure. All of the customer data is available for download using APIs or our web portal should it be needed as you develop your own data science capability.

Our digital insurance platform will allow you to deploy advanced digital products that will save operational costs, improve fraud detection and increase your customer profile knowledge. You will be able to underwrite more accurately, influence end user behaviour to present less risk and then more efficiently manage a claim when one does occur.