Many of you will know Inzura for our innovative app-based telematics solution and our InzuraGo policy admin app - both products are groundbreaking in their own way, with both focussed on delivering efficiencies to our broker customers along with a compelling engaging experience to the policyholder. This customer centric approach is our guiding principle and along these lines I’m pleased to say that we are now ready to announce our next generation product iApprove.

Building on the feedback and data from the InzuraGo policy admin app, we have created a service that revolutionises the way policyholders onboard and communicate with brokers. The buying process for most personal lines insurance is not ideal potentially involving multiple website visits, re-typing of information, phone calls and often emailing of documents to the insurer. This is inconvenient for the policyholder but also time consuming and inefficient for the broker to manage.

Quite often proper policyholder detail checks are left until a claim comes in which leads to huge uncertainties around underwriting accuracy and therefore ultimately higher pricing. Insurers who are exposed to these higher risks are now insisting on more detailed checks when the policy is first sold. This is all very well but the cost and complexity of doing this is pushed to the broker and unfortunately the legacy systems in use can’t easily be adapted to do the job…

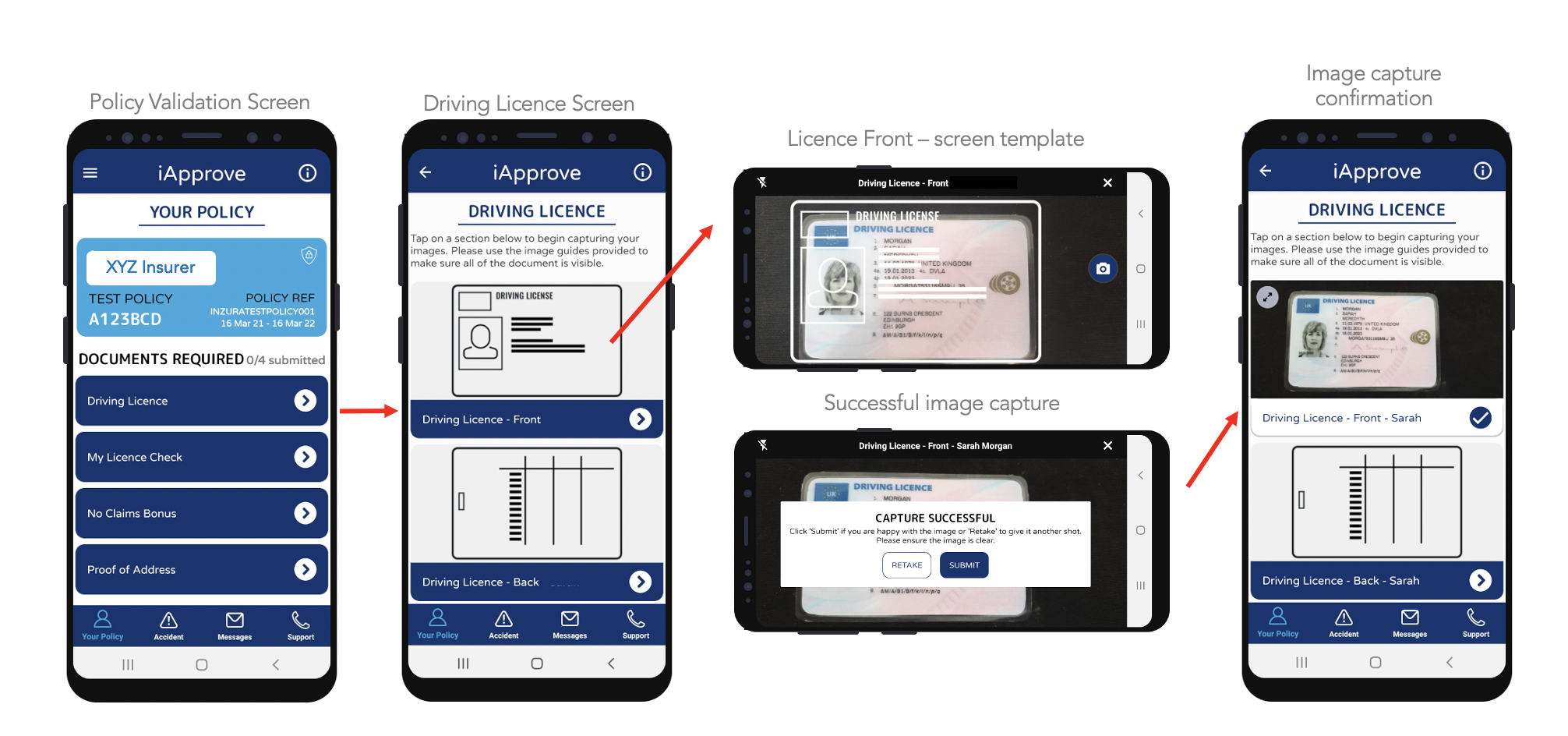

This is where iApprove comes in. We have created a standalone service that works alongside existing policy admin systems to automate the onboarding and verification of the documents needed to support a new policy. Policyholders use the iApprove app to upload documents to our service. If the documents match declared details, the policy is automatically approved and no further action is needed. If the details don’t match, the broker will be notified via our portal so a premium adjustment can be generated based on the actual details provided. For example, the years no claims might be different, the address may be incorrect or the number of points on the licence might not match. Policyholders can even chat with the broker agent via the in-app chat facility saving even more time and frustration on the phone.

The key benefits are:

- Over 95% of policyholders will download the iApprove app and use it to upload documents

- iApprove takes 2 to 3 minutes of policyholder time while saving up to 28 minutes of broker agent time per policy

- Brokers can identify up to 15% of additional premium with iApprove

- In-app chat replaces live-calls saving 8 minutes of agent time per customer contact

We deliver all of these benefits without a complex systems integration project. iApprove works alongside your existing systems and can be deployed in days not months. We are truly excited about the benefits iApprove will deliver to brokers and policyholders alike.

Our pricing model is also very simple. There are no up-front fees, no monthly minimums, just a simple ‘Pay as you Go’ model based on fees per document starting from as little as £1.

Contact us to find out how iApprove can bring you major cost savings, improved efficiencies and identify additional premiums. Feel free to sign-up for a free trial of iApprove to see for yourself http://inzura.ai/signup

Regards

Richard Jelbert

CEO - Inzura