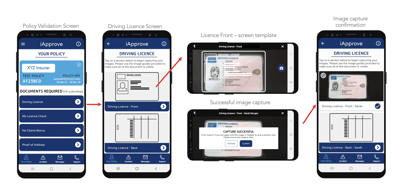

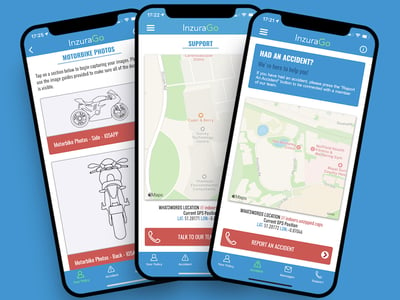

Many of you will know Inzura for our innovative app-based telematics solution and our InzuraGo policy admin app - both products are groundbreaking in their own way, with both focussed on delivering efficiencies to our broker customers along with a compelling engaging experience to the policyholder. This customer centric approach is our guiding principle and along these lines I’m pleased to say that we are now ready to announce our next generation product iApprove.

14th October 2020: Fresh Insurance, part of Kingfisher UK Holdings, has today announced a partnership with Insurtech Inzura to deploy an innovative new policy document validation app across three of its motor brands: Autosaint, Ladybird and First Van. In trials the broker has already seen an app download rate of over 85% and as a result the entire validation process is now 80% faster.

14th January 2020: Inzura, the UK based InsurTech, has today launched the first fully digital DashCam solution with automatic video FNOL. Brokers, insurers and MGAs can now offer a DashCam supported insurance product with a high quality DashCam unit and supporting app under their own brand name, and for a fraction of the cost of traditional solutions.

At Inzura we collect and process huge amounts of data for each our insurance clients each month. We manage GPS location data for telematics, app usage data, policy document photos, vehicle and property data as well as video files from dashcams. We generate insight from this data to help with tactical issues like cost savings and fraud detection but also do aggregate analysis for longer term strategic product planning and pricing. We are constantly looking for ways to enhance the data-driven intelligence and insight we deliver to our insurer and broker customers.